Recently, the first two months of 2021 sales data for the household goods category were made public, and year-on-year, the market has recovered very well.

Domestic retail market, mainly look at three types of data, one is the BHI of the Building Materials Circulation Association; second is the total retail sales of furniture and decoration materials published by the Bureau of Statistics; third is the sales data published by key enterprises in the industry.

For foreign trade, it is mainly the export data of furniture, ceramics and lighting published by the General Administration of Customs.

The study found that, compared to 2020, the demand for home furnishings was said to be concentrated and the market performed quite well. However, compared to 2019, there is still some room for recovery and the market still needs to work hard.Household Goods

Domestic market: the situation from January to February 2021

According to the National Bureau of Statistics, furniture retail sales from January to February were $22.3 billion, up 58.7% year-on-year. In contrast, in 2019, retail sales in the first two months were 25.7 billion yuan. There is still some way to go before 2019 and there is still room for the market to recover.

Retail sales of home appliances were RMB115.2 billion, up 43.2% year-on-year.

Retail sales of consumer goods in the construction and decoration category amounted to RMB 22.1 billion, up 52.8% year-on-year, but 16.3% lower than the same period in 2019. This was mainly due to the relatively small base in 2020, which was more significantly affected by the epidemic, and this part did not return to the level of 2019.

Looking at the sales of building materials and home furnishing stores, according to the Department of Circulation Development of the Ministry of Commerce and the China Building Materials Circulation Association, the sales of building materials and home furnishing stores above the scale were RMB75.55 billion, down 8.59% sequentially and up 25.45% year-on-year.

Then in February, sales were 45.03 billion yuan, down 40.39% from a year earlier, up 11,604.9% year-on-year.

Adding up the first two months, cumulative sales were 120.58 billion yuan, up 98.95% year-on-year.

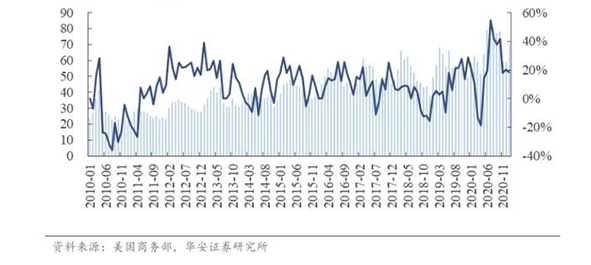

Foreign trade: January-February 2021

Cumulative exports of furniture and its parts were $11.0 billion in January-February 2021, up 81.7% compared to the same period in 2020; and up 33.5% compared to January-February 2019.

Textile exports amounted to 22.1 billion, up 60.8%; lamps and lanterns 7.82 billion, up 122.1%; and ceramics 4.09 billion, up 76.6%.

Across the board, the export market is not only up on 2020, but also better than 2019, with stronger exports starting in the second half of 2020, which have been going on for longer and are expected to influence the trend throughout the year.

There is one more key sector to consider, how is real estate faring?

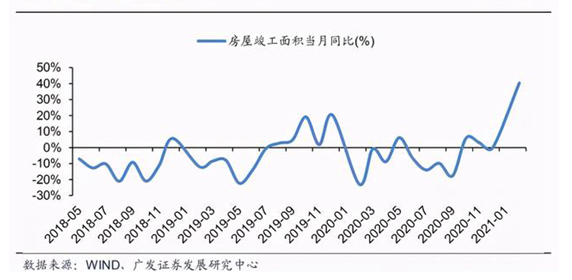

From January to February, 127 million square metres of new residential construction were started, up 68.5% year-on-year, while 986.2 million square metres of residential completions were completed, up 45.9%.

The situation is very good, especially the significant growth in completed areas, which is expected to provide a strong boost to the consumer market for furniture, decoration materials and home appliances in the second half of 2021 and 2022.

It is also understood that there was a peak in sales of commercial properties in 2017 and 2018, with sales of 1,694.08 million sq m in 2017, up 7.7% year-on-year. 2018 was 1,716.54 million sq m, up 1.3% year-on-year. 2019 is 1,715.58 million sq m, down a modest 0.1%.

Many of the new houses built in these three phases are reaching their delivery dates.

Therefore, in theory, residential construction will see completion around three years after it starts, so 2020 to 2021 is the peak year for housing completions.

However, housing completions in 2020 fell year-on-year, with overall completions of 912.18 million square metres, down 4.9%; of which residential completions were 659.1 million square metres, down 3.1%.

There is a delay in completions, but it will not disappear. Some of the houses that were supposed to be completed and delivered in 2020 will be delayed until 2021, so this could be a big year for completions.

What about the reality? To a certain extent, it matches the theoretical predictions.

According to the National Bureau of Statistics, from January to February 2021, 135.25 million square metres of housing were completed, an increase of 40.4%. Of this, 98.62 million square metres of residential completions were completed, an increase of 45.9%.

There was a significant increase in completions!

And since October last year, the completed area has maintained a year-on-year increase, for example.

The completed area in October rose by 5.9% year-on-year, a substantial increase of 23.5 percentage points over September, which is astonishing.

The good momentum continued in November, with completions up 3.1% year-on-year and 25.7% sequentially.

Several consecutive months of positive year-on-year growth, the completion situation all the way upward, bright performance, and after completion will be the delivery of the property, decoration and purchase of furniture and soft furnishings one after another into the upward track.

Big Material Research noted that transactions in the second-hand property market were equally good.

According to data from the Shell Research Institute, in the first quarter of 2021, second-hand property transactions in the country’s key 18 cities hit a single quarterly high since 2017, up 14% from the fourth quarter of 2020 and some 2.6 times higher than the same period last year.

The overall picture for 2020 was not too bad either, with 4.2 million second-hand home transactions for the year, albeit down slightly by 1.3%, mainly due to the impact of the early part of the epidemic, before achieving significant growth in some of the later months.

And according to data from Zhuge Finder, 10 key cities saw over 1.05 million second-hand residential transactions in 2020, up 7.5% year-on-year.

Theoretically speaking, the interval between the transaction of second-hand houses and renovation and renovation will not be too long, often in 1 to 6 months, and the conduction to the home furnishing industry will be fast.

According to Big Material Research, the firm volume of second-hand housing transactions will continue to drive consumer demand for home furnishings and building materials in the short term, and for now, at least the first half of 2021 has a relatively good market base.

What will happen to the home furnishing market in the future? Big Material Research has noted some additional new data about the volume of new commercial and new housing transactions in 2019 and 2020, and it is expected that, without surprise, the market will not be bad after 2022.

According to the National Bureau of Statistics, 1,760.86 million square metres of commercial housing will be sold in 2020, an increase of 2.6% year-on-year, which provides a strong basis for completion and delivery in two to three years’ time.

The area of new construction starts is 1,643.29 million square metres, down 1.9%, but by the first two months of 2021, new construction starts are up by a whopping 64.3%, including 68.5% growth in residential housing.

There are also statistics from the Shell Research Institute, which show that in the first quarter of 2021, the number of new home transactions in 66 cities nearly doubled year-on-year, and also increased by as much as 40% compared to the same period in 2019.

In terms of units, the transaction momentum was equally impressive compared to the same period in 2019, with the number of new home transactions in first-tier cities increasing by 58.5%, second-tier cities by 32.6% and third- and fourth-tier cities by 43.8% in the first quarter.

Big Material Research believes that the significant growth in new home transactions, two to three years later, has laid the foundation for the home furnishing market in advance.